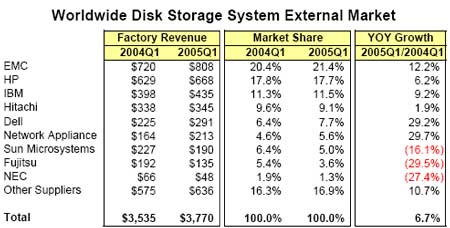

Network Appliance and Dell were the fastest-growing storage vendors in the first quarter, according to IDC, posting year-over-year external storage revenue growth of nearly 30 percent each.

EMC, the third-fastest grower among the top vendors at 12.2 percent, continued to expand its lead in the external storage market, increasing its market share from 20.4 percent in the first quarter of 2004 to 21.4 percent in the first quarter of this year (see table at bottom).

With their large internal (server-based) storage businesses, HP and IBM remained the leaders in the overall disk storage market, followed by EMC. HP and IBM grew overall storage revenues about 4 percent each, with external storage revenues growing at a faster rate, according to IDC.

Among the top vendors, Sun Microsystems, Fujitsu and NEC fared the worst, with double-digit year-over-year storage revenue declines.

According to IDC’s Worldwide Disk Storage Systems Tracker, factory revenue in the worldwide external disk storage systems market grew 6.7 percent year over year to $3.8 billion in the first quarter, marking the eighth consecutive quarter of positive overall growth. The total disk storage systems market grew at a year-over-year rate of 6 percent to $5.5 billion.

Capacity continues to outpace revenue growth by a wide margin, with external disk storage systems petabytes growing 58.6% year over year to 409 petabytes in the first quarter, as midrange systems and higher-capacity drives like SATAcontinue to post strong growth.

“Storage spending is clearly trending upward as organizations strive to stay ahead of their information storage demands,” stated Brad Nisbet, program manager in IDC’s Storage Systems Program. “After nearly two years of positive momentum, spending on storage systems, particularly those priced less than $300,000, continues to be a top priority in the ongoing efforts to expand and rebuild IT infrastructure.”

Partnerships are becoming an increasingly important component of vendors’ market strategies, noted IDC senior research analyst Natalya Yezhkova. “This mutually beneficial approach allows each partner to offer more complete solutions for its customers and often opens a door to new market segments and leads to growth in revenue and market shares,” Yezhkova said.

Networked Storage, iSCSI Continue Rapid Growth

The total network storage market (NAS combined with open and iSCSI SAN) posted 16.7 percent year-over-year growth to more than $2.3 billion in the first quarter. EMC maintained its lead in the total network storage market with a 29 percent share, followed by HP with 20.4 percent. Dell and NetApp posted the strongest year-over-year revenue growth among the top five vendors, with 47.1 percent and 29.7 percent growth, respectively.

In the Open/iSCSI SAN, EMC took the lead from HP with a 26.7 percent revenue share, ending four consecutive quarters of sharing the top slot with HP. HP ended the quarter with a 23.9 percent share. The Open/iSCSI SAN market grew 16.6 percent year over year, reaching nearly $1.9 billion.

There was a bit of controversy in the NAS market. IDC revised its taxonomy to include EMC’s Centera content addressed storage (CAS) platform. The result catapulted EMC into first place in the NAS space over NetApp, which objected. CAS is object-based storage, which differs from the file-based NAS, NetApp pointed out. IDC had EMC leading NetApp 37.9 percent to 34.2 percent in the NAS space, but NetApp said that without CAS, it would have expended its NAS lead to 38 percent to 31 percent over EMC.

The iSCSI SAN market continued to show strong momentum in the first quarter, with 22 percent sequential revenue growth over the fourth quarter. NetApp continued to lead the market with 43.3 percent share, followed by EMC with 28.6 percent share.

|

| Source: IDC |