HPE placed first in the modestly resurgent market for enterprise storage systems during the second quarter (Q2) of 2017.

Data storage vendors breathed a little sigh of relief in Q2. During the quarter, enterprise storage system sales notched up 2.9 percent on an annual basis, reversing a persistent market decline, according to the latest research from International Data Corporation (IDC).

Revenue totaled $10.8 billion in Q2 and the amount of storage capacity shipped jumped 16.5 percent year-over-year, exceeding 65 exabytes.

“The enterprise storage market finished the second quarter of 2017 on a positive note, posting modest year-over-year growth and the first overall growth in several quarters,” said IDC research manager Liz Conner, in prepared remarks. “Traditional storage vendors continue to expand their product portfolios to take advantage of the market swing towards all flash and converged/hyperconverged systems. Meanwhile, hyperscalers saw new storage initiatives and event-driven storage requirements lead to strong growth in this segment during the second quarter.”

Sales of all flash arrays hit $1.4 billion, a year-over-year gain of 37.6 percent. Hybrid flash arrays generated $2.1 billion in revenue for vendors. Server-based storage revenue dropped 13.4 percent to $2.9 billion, according to the analyst firm.

Demand for traditional external storage arrays continues to slip, but they still represent the largest slice of the pie. Sales in Q2 hit $5.3 billion, a 5.4 percent year-over-year decline.

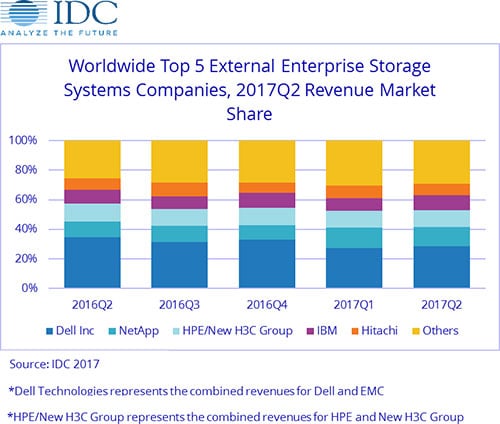

Combined, HPE and its Chinese joint venture New H3C Group, led the pack with 20.1 percent of the overall market and second-quarter revenue of $2.17 billion, a 13.2 percent annual drop. Dell, now home to EMC’s storage portfolio, was a close second with 18.4 percent of the market on revenues of $1.99 billion, a 26.7 percent decline compared to the same quarter last year.

NetApp, IBM and Hitachi round out the top five. Among these top storage providers, NetApp was the only company to grow revenue and market share. NetApp generated over $694 million in sales, a year-over-year increase of 16.7 percent, and laid claim to 6.4 percent of the market compared to 5.7 percent in Q2 2016.

As a group, original design manufacturers (ODMs) are basking in the intense demand for enterprise cloud services. Their direct sales to hyperscale data centers totaled $2.5 billion in Q2, a whopping year-over-year increase of 73.5 percent.

Pedro Hernandez is a contributing editor at Enterprise Storage Forum. Follow him on Twitter @ecoINSITE.