Hyperscale data center operators are increasingly turning to original design manufacturers (ODMs) for their data storage needs, according to the latest market data from IDC.

In total, the market for enterprise storage systems jumped 14 percent in the third quarter (Q3) of 2017 on an annual basis, reaching $11.8 billion. Collectively, ODMs that sell to hyperscale data center customers saw their sales skyrocket to nearly $2.7 billion, a 54.8 percent year-over-year increase.

All-flash arrays continued their invasion of the data center in Q3. This segment of the market generated nearly $1.6 billion in sales, a year-over-year of gain of 38.1 percent. Meanwhile sales of hybrid flash arrays hit $2.3 billion in Q3.

“The enterprise storage market finished the third quarter of 2017 on a positive note, posting strong year-over-year growth and the first double-digit growth in several years,” said IDC research manager Liz Conner in a statement. “All Flash, software-defined, and converged/hyperconverged systems continue to be the driving force for traditional storage vendors. Meanwhile, hyperscalers once again saw event-driven storage requirements lead to strong growth in this segment during the third quarter.”

Demand for traditional, disk-based arrays also picked up. Sales of external storage systems segment hit $5.6 billion in Q3, a year-over-year increase of 4.1 percent.

Hewlett Packard Enterprise (HPE), including its New H3C Group joint venture in China, continues to lead the enterprise storage market, with sales of over $2.3 billion in Q3 and a 20.2 percent of the market. Dell is a close second with $2.2 billion in sales and nearly 19 percent of the market.

NetApp took third place with $700 million in sales and a six percent share of the market. IBM and Hitachi tied for fourth place, each with around four percent of the market and $508.7 million and $475.9 million in sales, respectively.

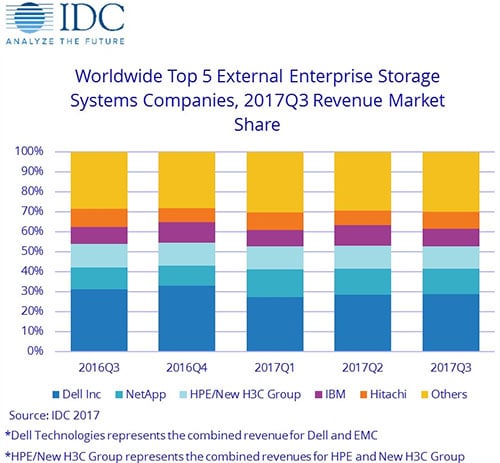

In terms of external storage arrays, Dell EMC reasserted its dominance, with $1.6 billion in sales and nearly 29 percent of the market. Second-place NetApp raked in just over $700 million and claimed 12.5 percent of the market.

HPE ranked third, with $637.6 in revenue and a 11.4-percent share of the market. Again, IBM and Hitachi tied for fourth place, each with over eight percent of the market and north of $460 million in sales for Q3.

Pedro Hernandez is a contributing editor at Enterprise Storage Forum. Follow him on Twitter @ecoINSITE.